How To Calculate Hst From Total In Excel

Sometimes you may get the price exclusive of tax. The reason is that the SUM function calculates the subtotal values with the actual data.

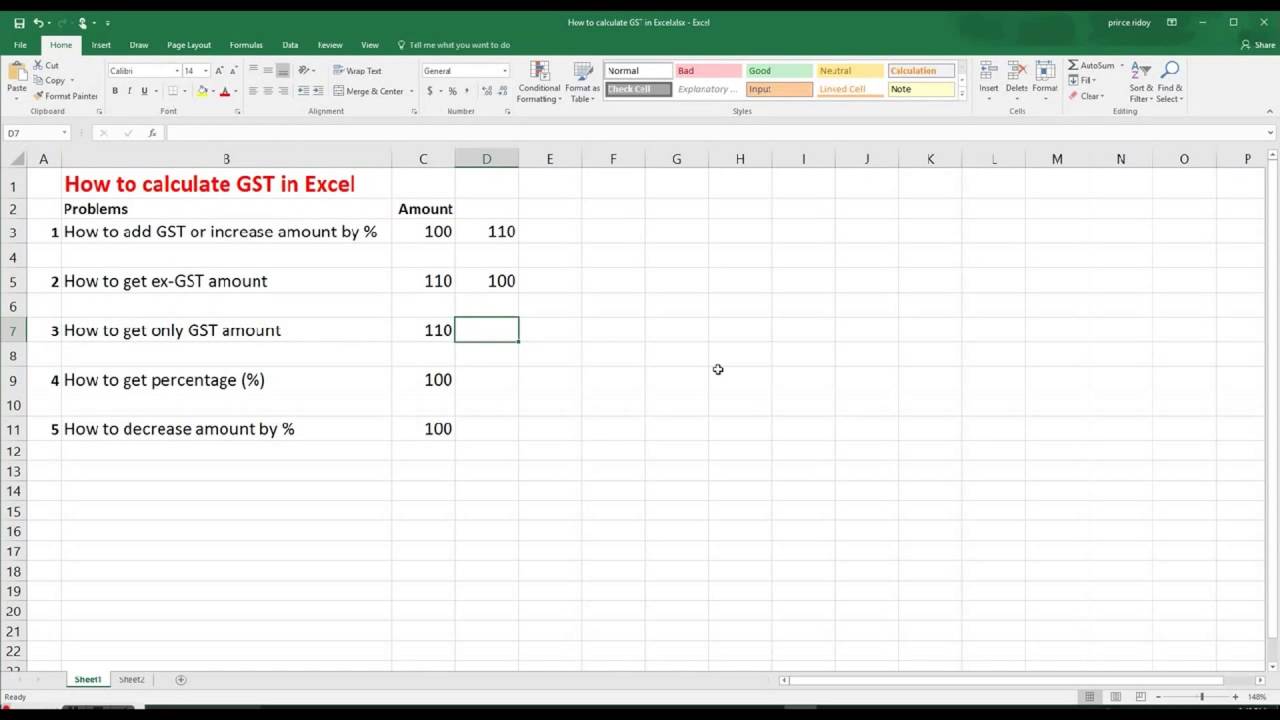

Best Excel Tutorial How To Calculate Gst

On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

How to calculate hst from total in excel. Substitute the cells containing the tax and the total price in the above formula. The following table provides the GST and HST provincial rates since July 1 2010. And now write the percentage of tax in column B.

Function qtyfindlevel As Range As Double Dim i temp qtyClm tQtyClm Change the Column name to match if different qtyClm WorksheetFunctionMatchQTY Range11 tQtyClm WorksheetFunctionMatchTOTAL QTY Range11 If level 1 Then temp CellslevelRow qtyClm Else For i levelRow To 2 Step -1 loops bottom up If Cellsi levelColumn levelvalue - 1. Click the cell D11 copy and paste formula C11-B11 24 into the Formula Bar and press Enter key. GSTHST provincial rates table.

Tushar Mehta MVP Excel. Type of supply learn about what supplies are taxable or not. Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly.

Then apply the Tax Amount Calculator formula in column C as shown in the picture below. Select the cell you will place the calculated result enter the formula B1B2 B1 is the price exclusive of tax and B2 is the tax rate and press the Enter key. HSTTotal513 HSTTotal813 HSTTotal can be a formula a link to a cell with the total or a number.

HttpsgooglUDyNx4In this video were going to add our a. Calculate the GST component to be added to a GST exclusive. In order to calculate sales tax with Excel type in the amount of a purchase and multiply it by the states sales tax which has to be converted into decimal.

All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. You can also calculate the value of your product with tax in a single formula. See the articleTax rate for all canadian remain the same as in 2017.

It is very easy to use it. Calculate sales tax if you get price exclusive of tax. 100112X which is the same as 1112X.

In the third column enter. 49573013 Total HST Collected divided by 13 381331 Total Fares 381331 x 0078 Total Fares x 78 quick method minus 1 credit 29744 So my HST. Current HST GST and PST rates table of 2021.

Learn how to write formulas in Excel to calculate GST at 15. Then add these two Amounts in Column D You will be presented with the Tax. Explanation of the calculation.

Change D3 to of Total. In this example we divide each month by the total at the bottom of column B. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value.

In the example below the SUM function is used to calculate the total of each Home Expenses and Transportation as well as a grand total. Price including VAT Price Tax To calculate the price including VAT you just have to add the product price the VAT amount. Click on C3 and AutoFill one cell across to D3.

Formula to add the price and the tax. Although the total expense value should be 655 455 200 the formula in cell F28 shows 1310. First we take the price of the product 75 And we add the calculation of the amount of tax.

You have a total price with HST included and want to find out a price without Harmonized Sales Tax. In the first column enter the price2. Then in the second column enter the sales percentage3.

Now first of all write down the amount you want to calculate tax in column A. How to Calculate Sales Tax in Excel1. Or more generally 1 1tax X.

Current HST rates are listed below the HST calculator. Whether with Excel or with pencil and paper the way to calculate a percentage of total is with a simple division. The rate you will charge depends on different factors see.

In this condition you can easily calculate the sales tax by multiplying the price and tax rate. Where the supply is made learn about the place of supply rules. In the tutorial I show you how to.

And format it as a percentage.

Formulas To Include Or Exclude Tax Excel Exercise

Excel Formula Sum If Ends With Exceljet

How To Calculate Sales Tax In Excel

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Sales Tax In Excel

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

10 Sales Invoice Templates Word Excel Pdf Templates Invoice Template Word Invoice Template Computers For Sale

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Excel Invoice Template Invoice Template Gallery Invoice Template Invoice Format In Excel Invoice Template Word

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst At 15 Using Excel Formulas Excel At Work